The copper processing industry involves the process of obtaining pure copper from natural copper ores through mining, beneficiation, and smelting, followed by producing copper materials or copper alloy materials through plastic processing and heat treatment. Its products include copper plates, copper strips, copper wires, copper tubes, copper rods, copper foils, etc. Due to the high electrical conductivity, thermal conductivity, and ductility of copper materials, they are widely used in power, construction, transportation, electronics, home appliances, and other fields.

As an important part of the non-ferrous metal industry, the copper processing industry plays a dual role in providing basic materials and supporting industrial upgrades in the national economy. In recent years, with the global industrial market shifting to developing countries, China, with its resources and manufacturing base, has become the largest producer and consumer of copper materials in the world. As the industry continues to expand, technological iterations and demand upgrades are driving the industry towards high-end and green transformations.

Analysis of the Current Situation of the Copper Processing Industry

Demand Structure Upgrade Drives Industry Growth

According to Zhongyan Network, the demand growth in the copper processing industry is closely related to macroeconomic cycles and industrial upgrades. Currently, the power industry remains the core field of copper material consumption, with the rapid development of the new energy sector being the main driving force. The expansion of installed capacities for renewable energy sources such as photovoltaic and wind power has significantly increased the demand for transmission cables, transformers, and other equipment, thereby driving a substantial increase in copper material consumption.

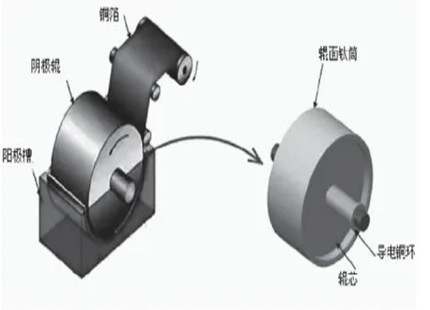

Meanwhile, the explosive growth of the new energy vehicle industry has further expanded the application scenarios for copper: substantial amounts of copper materials are required for components such as power battery connection pieces, conductive parts of charging piles, and vehicle motor windings, with the copper usage per new energy vehicle being several times higher than that of traditional fuel vehicles. Moreover, new infrastructure projects like 5G base station construction and data center expansion, as well as the trend towards thinner and high-performance consumer electronic products, are driving demand growth in niche markets for high-precision copper foils and high-frequency high-speed copper cables.

Coexistence of Capacity Expansion and Structural Contradictions

After years of development, China's copper processing industry has formed a complete industrial chain layout, with the largest capacity scale in the world. However, rapid capacity expansion has led to intensified homogenized competition in mid-to-low-end products, resulting in overcapacity in certain areas.

At the same time, high-end copper materials still rely on imports, such as high-performance copper alloys for aerospace and copper strips for integrated circuit lead frames, with low localization rates. Technical barriers and insufficient process stability impede the pace of industrial upgrades. In terms of regional distribution, copper processing capacity is highly concentrated in the Yangtze River Delta, Pearl River Delta, and Bohai Rim regions, with Zhejiang, Jiangxi, Jiangsu, and Anhui provinces accounting for more than half of the national output, making regional collaboration and resource integration key to optimizing industrial layout.

Technological Innovation Driving Industrial Upgrades

Faced with demand upgrades and competitive pressures, copper processing companies are increasing their R&D investments, enhancing product added value through technological innovation. In the field of process equipment, the popularization of continuous casting and rolling technology, horizontal continuous casting technology, and high-precision rolling technology has significantly improved the dimensional accuracy and surface quality of copper materials;

In material research and development, the development of new copper alloy materials such as copper-nickel alloys and copper-aluminum alloys meets the demand for high temperature, corrosion resistance, and high strength in special working conditions, expanding the application of copper materials in aviation, aerospace, automotive, and other fields. On the intelligent manufacturing side, the integration of industrial internet, big data, and artificial intelligence technologies achieves digital control and quality traceability of production processes, reducing energy consumption and operational costs.

Environmental Policies Forcing Green Transformation

With the advancement of the "dual carbon" goals, the copper processing industry faces strict environmental constraints. The rising costs of treating waste gas, wastewater, and solid waste generated during production compel companies to accelerate the transition to green manufacturing. Leading companies are reducing per unit product energy consumption and carbon emissions by adopting clean energy, optimizing process routes, and establishing circular economy parks.

For example, the promotion of recycled copper smelting technology not only reduces dependence on primary copper ores but also achieves efficient resource utilization through closed-loop recycling systems. Additionally, the increasingly mature technology for copper recovery from scrap wires and cables and electronic waste provides new material sources and growth points for the industry.

Analysis of the Competitive Landscape in the Copper Processing Industry

Leading Enterprises Dominating Technological Competition

China's copper processing industry exhibits a "head concentration, tail dispersion" competitive landscape. Leading companies like Jiangxi Copper, Ningbo Jintian Copper, Zhejiang Hailiang Co., Ltd., and Anhui Chujian New Materials dominate the high-end copper material market through scale advantages and technological accumulation.

These companies build industrial chain competitiveness from copper mining and selection to end-product manufacturing through vertical integration of the industrial chain, establishing overseas resource bases, and setting up national R&D centers. For instance, Jiangxi Copper uses world-leading flash smelting technology in the copper smelting process and focuses on developing high-precision copper plates and strips and electromagnetic wires in the copper processing stage, forming a differentiated competitive advantage.

Small and Medium-sized Enterprises Focusing on Niche Markets

Numerous small and medium-sized enterprises (SMEs) are limited by funds and technology strength and find it challenging to directly compete with leading companies in high-end fields, opting instead to focus on niche markets by meeting differentiated demands through specialized production and flexible services. For example, some companies focus on copper foil production, developing ultra-thin copper foils suitable for lithium-ion batteries and flexible circuit boards by adjusting electrolytic process parameters; other companies prioritize building industry needs by developing copper pipes with antibacterial and self-cleaning functions.

However, SMEs generally face challenges such as financing difficulties and insufficient innovation resources. Homogenized competition leads to low-profit margins, with significant pressures for industry consolidation and transformation upgrades.

Intensifying International Competition

With the global focus of copper consumption markets shifting to Asia, international copper processing giants are increasing their presence in the Chinese market through joint ventures, technology cooperation, and other means to seize market shares. Meanwhile, leading Chinese companies are actively expanding overseas markets, building global supply chain systems by acquiring overseas copper mine resources and establishing overseas production bases.

For example, Jintian Copper set up a production base in Vietnam to serve the Southeast Asian market, while Hailiang Co., Ltd., through acquiring European copper pipe enterprises, gained advanced technology and customer resources. The intensifying international competition requires companies to possess cross-cultural management, localized operations, and global resource allocation capabilities.

Analysis of Future Development Trends in the Copper Processing Industry

High-end: Overcoming Technical Bottlenecks to Meet Emerging Field Needs

The development of emerging industries such as new energy, semiconductors, and aerospace sets higher performance requirements for copper materials. In the future, the copper processing industry will focus on breaking through the following technical directions: firstly, developing high-strength and high-conductivity copper alloys to meet the lightweight and high-efficiency demands of new energy vehicle motors and high-speed rail contact networks;

Secondly, improving the uniformity and surface quality of copper foils to adapt to the technological requirements of integrated circuit packaging and solid-state batteries; thirdly, developing high-temperature and radiation-resistant copper alloys to serve extreme environments such as nuclear power and deep space exploration. Moreover, establishing national innovation platforms through industry-academia-research cooperation to accelerate the transformation of scientific research achievements will be a key path to overcoming technical bottlenecks.

Green: Adhering to Low-Carbon Concepts and Building a Circular Economy System

Tightening environmental policies and heightened consumer awareness will drive a comprehensive green transformation in the copper processing industry. Companies need to advance from three aspects: first, adopting clean energy and low-carbon processes on the production end, such as using hydrogen energy as a reducing agent instead of natural gas to reduce carbon emissions; second, designing recyclable and easily disassembled copper-based materials on the product end to improve resource utilization rates; third, building a closed-loop recycling network in the industrial chain, collaborating with recycling companies and end-users to ensure efficient reuse of scrap copper materials. It is expected that the share of recycled copper production will significantly increase in the next five years, becoming an important raw material source for the industry.

Intelligent: Integrating Digital Technologies to Improve Production Efficiency and Quality

Intelligent manufacturing is an inevitable choice for the transformation and upgrading of the copper processing industry. By deploying industrial internet platforms, companies can achieve equipment interconnection, data collection, and real-time analysis, optimizing production plans and process parameters; digital twin technology can simulate production processes, identifying quality defects and equipment failures in advance;

AI algorithms can optimize supply chain management, reducing inventory costs and response times. Furthermore, the widespread adoption of 5G technology will facilitate remote maintenance and unmanned workshops, further enhancing industry automation levels.

Internationalization: Deepening Global Layout and Enhancing International Competitiveness

Faced with challenges such as international trade frictions and regional economic integration, copper processing companies need to mitigate risks, obtain resources, and access markets through international operations. On one hand, securing stable raw material supply through acquiring overseas copper mining companies or signing long-term supply agreements;

On the other hand, establishing production bases in emerging markets such as Southeast Asia and the Middle East to meet local customer demand and avoid trade barriers. Additionally, participating in international standard setting and enhancing brand building will help improve the global influence of Chinese copper processing products.

English

English 한국어

한국어 français

français Deutsch

Deutsch Español

Español italiano

italiano العربية

العربية tiếng việt

tiếng việt Türkçe

Türkçe ไทย

ไทย 中文

中文